Performance

Business Performance

GRI 201-1

Know below the main highlights of our performance in 2018. The full disclosure of our financial statements is available on the Algar Telecom’s website.

| In million of Brazilian Reais | 2017 | 2018 | ∆ 2017/2018 |

| Gross revenue | 3,557.4 | 3,682.6 | 3% |

| Telecom | 2,606.2 | 2,698.4 | 3% |

| B2B* | 1,426.7 | 1,546.5 | 8% |

| B2C* | 1,212.0 | 1,168.6 | (4%) |

| Tech – BPO/IT Management | 951.2 | 984.2 | 2% |

| Net revenue | 2,715.5 | 2,867.3 | 6% |

| Telecom* | 1,884.4 | 2,012.5 | 7% |

| Tech – BPO/IT Management* | 883.8 | 906.1 | 2% |

| EBITDA | 780.0 | 967.5 | 24% |

| Margin % | 28.7% | 33.7% | – |

| Recurring EBITDA | 787.5 | 913.5 | 16% |

| Margin % | 29.0% | 31.9% | – |

| Net Profit | 229.6 | 316.1 | 38% |

| Margin % | 8.5% | 11.0% | – |

| Investments | 548.3 | 733.2 | 34% |

| Net Debt/EBITDA | 1.8 | 1.7 | – |

| Total B2B customers (un.) | 95,377 | 104,791 | 10% |

*Before intercompany eliminations.

Consolidated gross revenue

In 2018, Algar Telecom’s consolidated gross revenue reached R$3,682.6 million, up 3% over 2017. This evolution was driven by the growth in Telecom B2B clients (+8%), followed by the Tech – BPO/IT Management segment (+3%).

Telecom

Revenue from the Telecom segment, which at the end of 2018 represented 73% of the Company’s total revenue, grew by 3% in the year, totaling R$2,698.4 million. This performance is a result of the favorable performance of B2B customers (8%), partially offset by lower retail revenue (-3%).

B2B

With a 10% growth in the number of clients – 24% corporate and 8% MPE -, B2B customer revenue reached R$1,546.5 million in 2018. The increase of 8% over the previous year results from the expansion of services to new locations in the Southern and Southeastern regions and the start-up of our operations in the Northeastern region in the second half of 2018. With this purpose of speeding up this process, in November last year we concluded the acquisition, through a bidding process, of the second batch of Cemig Telecom’s assets, in the states of Bahia, Pernambuco, Ceará and Goiás, totaling another 1,200 km of network. In addition to opening new locations and enabling a greater capillarity, the acquired network strengthens the robustness of data traffic through redundancies of stretches already built by Algar Telecom. By the end of 2018, B2B customers accounted for 57% of our Telecom segment revenue.

| B2B operating data | 2017 | 2018 | ∆ 2017/2018 |

| Number of customers (units) | |||

| Total | 95,377 | 104,791 | 10% |

| Corporate | 10,919 | 13,550 | 24% |

| Small and Micro Enterprises (SMEs) | 84,458 | 91,241 | 8% |

B2C

B2C customer revenue totaled R$1,168.6 million in 2018, down 4% over the previous year, mainly due to the decrease in voice services – both mobile and landline – and TV.

| B2C operating data (thousand)* | 2017 | 2018 | ∆ 2017/2018 |

| Data | 515 | 543 | 6% |

| Landlines | 756 | 736 | (3%) |

| Mobile | 1,313 | 1,290 | (2%) |

| Paid TV | 98 | 83 | (15%) |

* Data published by Anatel.

Information includes the concession area and cities operated in the H band.

Data includes both retail customers and business customers.

Tech – BPO/IT Management

In 2018, consolidated revenue from the Tech segment totaled R$984.2 million, up 3% over the previous year, reflecting the growth in revenue from Telecom Services Management and Customer Relationship Management/BPO.

Net operating revenue

Algar Telecom’s net operating revenue totaled R$2,867.3 million, up 6% over 2017.

Operating costs and expenses

Consolidated operating costs and expenses, excluding amortization and depreciation, totaled R$1,899.8 million in 2018, up 2% over 2017. This decrease was offset by positive non-recurring effects totaling R$60.7 million. Excluding these effects, the change in costs and expenses would have been 1%, lower than the growth in revenue.

The largest increases were in third-party services (R$43.8 million), advertising and marketing (R$10.4 million) and rentals and insurance (R$10.1 million), mainly due to services in new geographic regions. On the other hand, the main reductions in expenses were in personnel (-R$21.4 million) and Provision for Loan Losses – PCLD (-R$16.9 million). The decrease in personnel expenses is due to the actions of operational efficiency and the intensification of the use of digital tools in the Tech segment. In PCLD, there is a positive, non-recurring effect of R$8.7 million related to the impact of the adoption of IFRS 9 (international standard issued by the International Accounting Standards Board) in the fourth quarter. As a result of this, there was a decrease of R$8.2 million in provisions for doubtful debts, due to our strict credit and collection policy.

The positive non-recurring effects recorded in other operating income/expenses came from: (I) R$30.9 million referring to the exclusion of ICMS tax from the calculation base of PIS and Cofins contribution; (II) R$14.4 million related to the write-off of deferred taxes; and (III) R$6.7 million referring to the reduction of risks of labor lawsuits in the Tech segment, due to the STF’s (Brazil Supreme Court) decision on the outsourcing law.

EBITDA

In 2018, we recorded a consolidated EBITDA of R$967.5 million, up 24% over the previous year, when we recorded R$780.0 million. The consolidated EBITDA margin increased from 29% in 2017 to 34% in 2018, up 5 percentage points.

| 2017 | 2018 | ∆ 2017/2018 | |

| Telecom | 716.7 | 845.4 | 18% |

| % | 38% | 42% | – |

| Tech – BPO/IT Menagement | 63.3 | 122.1 | 93% |

| % | 7% | 13% | – |

| Consolidated | 780.0 | 967.5 | 24% |

| Margin | 29% | 34% | – |

The Telecom segment ended 2018 with R$845.4 million EBITDA, up 18% over the previous year. The margin, in turn, went up from 38% to 42%. Excluding non-recurring positive effects, totaling R$54.0 million, the 2018 margin is of 39%. The evolution of the margin, mainly due to the increase in revenue from B2B customer and actions in operational efficiency, would have been higher disregarding the operation expenses in the Northeastern region, which are in the initial phase and without due compensations in revenue.

EBITDA in the Tech – BPO/IT Management segment reached R$122.1 million in the year, up 93% over 2017. The recurring margin was of 13%. The 2018 cycle was important for the Tech segment. At the same time, since the company reformatted its portfolio of products and services, through a more intensive use of digital tools, it consolidated several actions of operational efficiency that were under implementation. This has made the company even more competitive for future growth.

Depreciation and amortization

In 2018, the volume of depreciation and amortization amounted to R$364.2 million, up 11% over the previous year, due to higher investments in the Telecom business, in projects that have already started operations focused on services quality, modernization and growth of networks.

Net financial result

We had a net financial result of R$137.6 million in 2018, down 3% over 2017. This decrease was due to the effect of the reversal of provisions resulting from the exclusion of ICMS tax from the calculation base of the PIS and Cofins contribution, which affected the account in R$24.2 million. Excluding this effect, there was an increase of R$7.9 million, due to: (I) lower financial income of R$4.1 million due to the lower CDI (Brazil base interest rate) for the period (2017: 10% x 2018: 6%) and (ii) higher financial expenses of R$3.8 million due to a higher IPCA (inflation index) rate (2017: 3% x 2018: 4%), applied on the balance of debentures tied to this indicator.

Net Profit

Net profit was of R$316.1 million in 2018, up 38% over 2017. Net income over net revenue margin was of 11% versus 8% in 2017. The evolution of net profit was driven by higher cash generation measured by EBITDA, partially offset by higher depreciation.

Debt

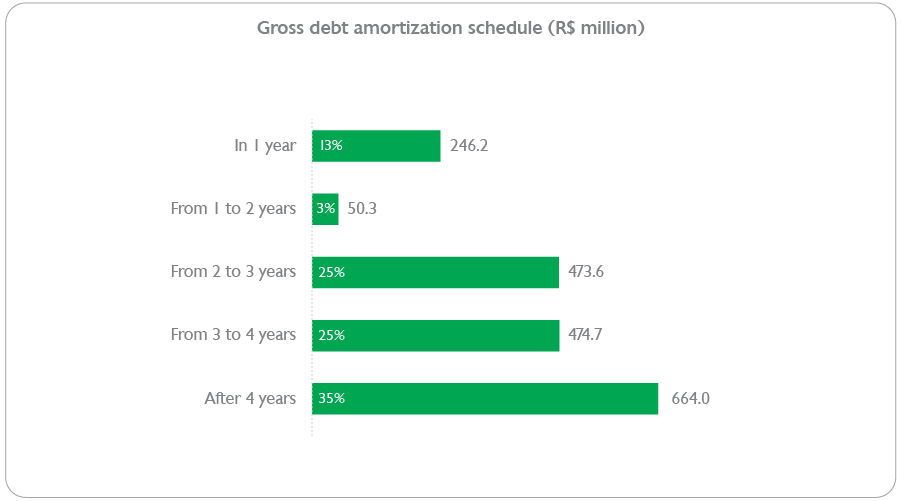

At the end of 2018, we recorded a consolidated gross debt of R$1,908.8 million, up 18% higher over December 31, 2017. The higher indebtedness is explained by two debt issuances carried out in the second quarter of the year (7th public issue of debentures and 1st public issue of promissory notes), partially offset by the amortization of more expensive and/or short-term debts, improving our debt profile, with about 85% of the debt maturing in over two years vs. the previous situation when only 60% had this profile. Net debt, in turn, increased 10% and we ended the year with a cash balance of R$362.0 million and a net debt of R$1,546.8 million.

Our debt profile is long-term, with 13% falling due in the short term and 84% with maturities longer than 2 years, a comfortable level for the Company. The net debt/EBITDA¹ ratio is 1.7x, consistent with the financial covenants.

As at December 31, 2018, 39% of the debt was indexed to the IPCA, 59% to the CDI rate, 1% to TJLP, and 1% was at fixed rates.

1For the calculation of the Net Debt/EBITDA ratio, the Company also considers the balance of R$4.7 million resulting from the acquisition of Optitel in 2015, which is allocated to “Securities payable (current liabilities) and other liabilities (non-current liabilities)” and the amount of R$25.6 million, recorded in the “Liabilities on the acquisition of equity interest”.

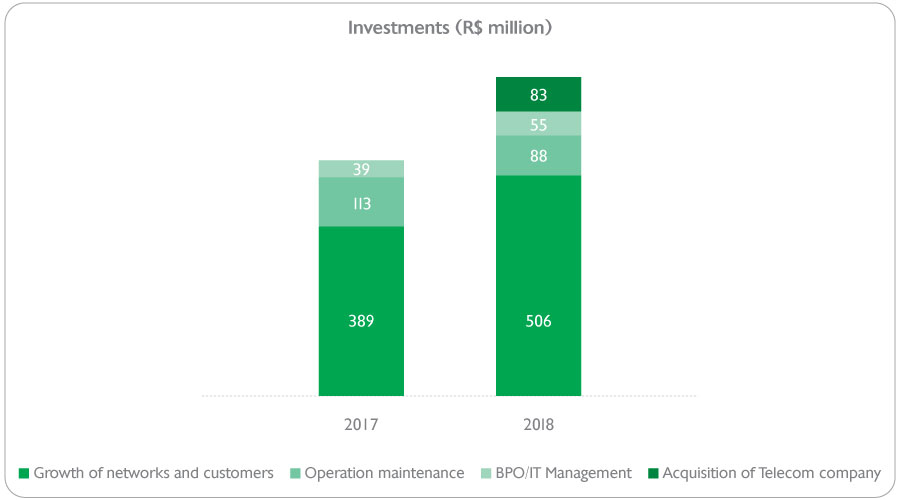

Investments

In 2018, we invested R$733.2 million. The greater part of these funds (69%), was channeled into network expansion – in particular the infrastructure necessary to provide data services to B2B customers, the modernization and expansion of broadband networks, taking fiber optics to homes instead of metal cables, and expanded mobile networks. To speed up the expansion in the Northeast, we acquired the second batch of assets of Cemig Telecom, which represented an investment of R$82.9 million.

The Tech segment, in turn, accounted for 8% of the funds (R$55.4 million), while R$88.4 million (12%) was used for operational maintenance and to ensure the quality of services.

Statement of Added Value (DVA)

| Consolidated | |||

| Thousand of Brazilian Reais | December 31, 2018 | December 31, 2017 | December 31, 2016 |

| Income | 3,855,886 | 3,660,741 | 3,430,095 |

| Sales of goods and services | 3,682,592 | 3,557,403 | 3,314,024 |

| Other revenue | 191,228 | 138,128 | 149,750 |

| Provision for doubtful debts | (17,934) | (34,790) | (33,679) |

| Inputs purchased from third parties (includes: ICMS, IPI, PIS and COFINS) | (1,061,812) | (991,784) | (930,441) |

| Cost of goods sold, and services rendered | (599,161) | (579,039) | (554,852) |

| Materials, energy, third party services etc. | (462,651) | (412,745) | (375,589) |

| Gross added value | 2,794,074 | 2,668,957 | 2,499,654 |

| Depreciation and amortization | (364,241) | (326,957) | (317,611) |

| Net added value by the entity | 2,429,833 | 2,342,000 | 2,182,043 |

| Added value received in transfer | 73,543 | 52,595 | 60,363 |

| Equity Income | – | – | – |

| Financial revenue | 73,543 | 52,595 | 60,363 |

| Added value to be allocated | 2,503,376 | 2,394,595 | 2,242,406 |

| Distribution of value added | 2,503,376 | 2,394,595 | 2,242,406 |

| Personnel | 866,501 | 893,321 | 888,085 |

| Tax, charges and contributions | 1,029,337 | 985,484 | 867,466 |

| Interest | 163,775 | 164,538 | 189,610 |

| Leases | 127,726 | 121,660 | 113,667 |

| Dividends | 105,082 | 76,637 | 63,078 |

| Earnings retained for the year | 210,955 | 152,955 | 120,500 |

Share

Share